So you've heard that there's a new counseling form that just replaced the old one that's been around for about 40 years so stay tuned because I'm going to talk to you about it and I'm gonna walk you through it and I'm gonna show you all the good things that the Army has done Roger sorry all right so welcome back to Roger summer and today we're going to be discussing Army counseling we're going to be discussing the new counseling form and I'm gonna give you guys some tips and tricks on like characteristics of counseling and um like the four stage counseling process as well just so you can understand the things that you need to do to be successful with the counseling process itself what is counseling counseling is the process used by leaders to review with subordinates the subordinates demonstrated performance and potential that's word for word out of the book but what does that actually mean all that means is that the that you're going to capture a specific amount of time in which the soldier performed then you're going to document it so as I said earlier there is a new DA form 4856 and this is a Monumental kind of like achievement for the Army because the last form hadn't been updated for about at least about over four a little bit over 40 years so this is huge and and the fact that the Army has done this it shows that they're moving in the right direction with the new form it kind of looks like a um it reminds me of an ncoer support form type thing because it outlines everything that you need to discuss with your troops so that's the good thing about that let's first talk about...

PDF editing your way

Complete or edit your da form 4856 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export army counseling form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your da 4856 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 4856 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form DA-4856

About Form DA-4856

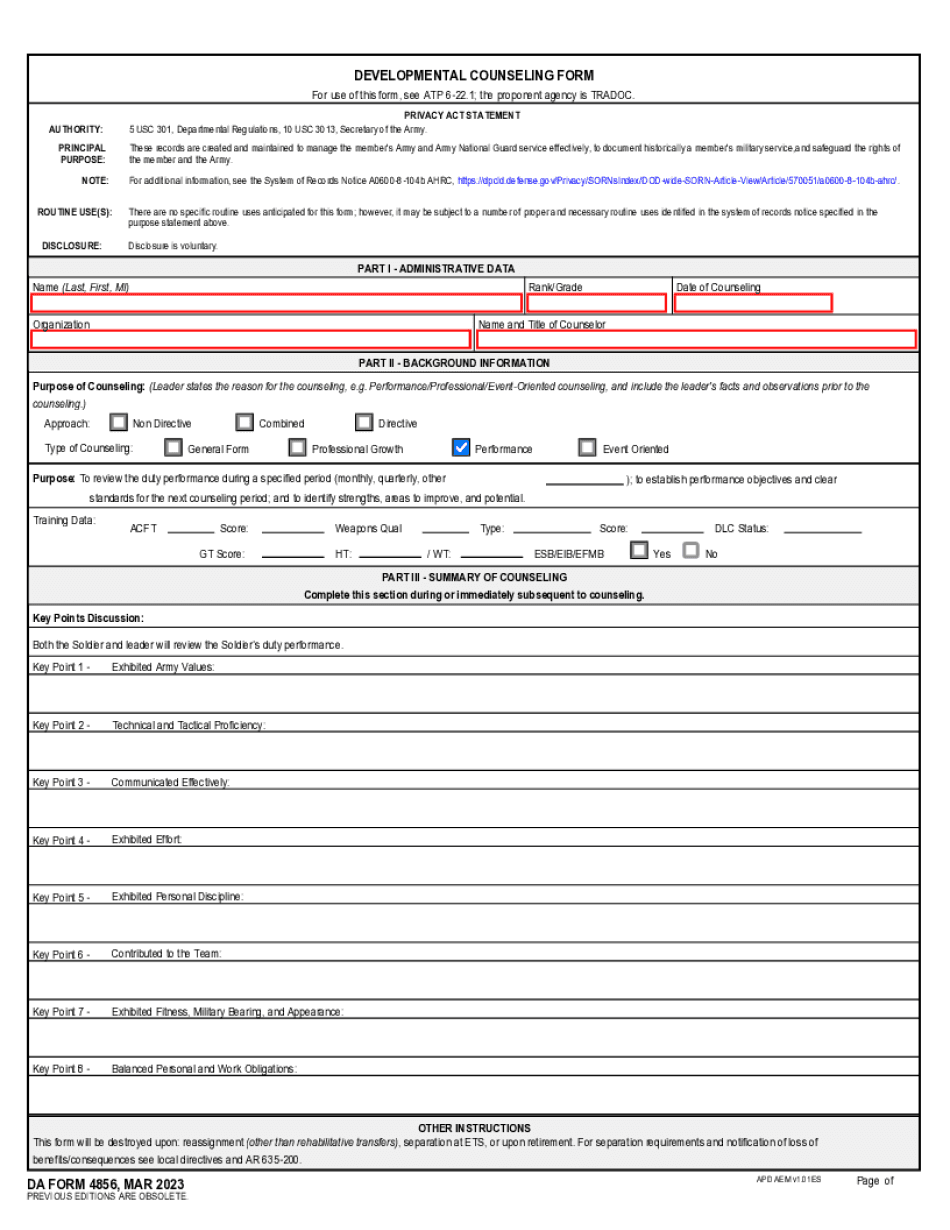

Form DA-4856, also known as the Developmental Counseling Form, is a document used by the United States Army. It is used to record counseling sessions between a leader and a subordinate, typically completed during individual preparations, evaluations, and regular feedback sessions. The purpose of Form DA-4856 is to provide a record of the counseling session that describes the individual's strengths, weaknesses, and potential areas for improvement. It also helps to set goals and provide guidance for the subordinate's professional development and career progression objectives. All Army personnel, including officers, enlisted soldiers, and cadets, who are either receiving or conducting counseling sessions are required to use Form DA-4856. It is an important tool for maintaining effective communication, monitoring performance, promoting professional growth, and ensuring accountability within the Army framework.

What Is Da Form 4856?

Each month the non-commissioned officers are obliged to prthe soldiers in the army with written counseling statement. With the help of scheduled counseling officers can help the soldiers to correct certain shortcomings and exclude any problems in the army.

The best way to record a counseling is to use the form DA-4856 which is intended for Developmental Counseling. This document is also used by leaders in order to help their subordinates to develop and prthem with some career related advices. Using DA-4856 leaders can easily provide feedback to the people they supervise.

On our site you will find a fillable da-4856 sample that can be easily filled out and submitted online. If required, you may print a form and further prepare it by hand. In order to customize a document according to your requirements, use an editable form template. Try all editing tools and prepare the needed document just in a few minutes.

How to fill out DA-4856?

DA-4856 consists of four parts which are placed on two pages.

- Part 1 captures an administrative data of a soldier who is going to be counseled and counselor`s name. Here prdetails about soldier`s name (including first, last and middle name) and rank. It is also important to specify the date on which the counseling is conducted and name of soldier`s organization.

- Part 2 of the form is filled out by the leader. Here he is required to specify the purpose for the counseling (for instance professional, performance or event oriented counseling). The leader`s observations and facts regarding the counseling are also to be provided.

- Part 3 of the blank form is related to summary of counseling. It is usually filled out immediately prior to or during the counseling by both the leader and the subordinate providing all necessary examples and observations. In section "Plan of action" the leader describes the subordinate`s actions which are to be carried out in order to reach agreed goal. The next section is session closing. Here the leader summarizes key points of a session and checks to which extent a subordinate understands the plan of actions.

- Part 4 represents assessment of the plan of action and evaluates if the plan of action is effective to reach a required result. It is filled in by both the counselor and individual. In order a DA-4856 to be legally binding, it has to be signed by both parties.

After a document is complete, check it for mistakes and sufficiency of information.

Online methods help you to prepare your document administration and improve the productiveness of one's workflow. Adhere to the quick guidebook with the intention to total Form DA-4856, avoid problems and furnish it in a very timely manner:

How to accomplish a Form DA-4856 over the internet:

- On the website along with the variety, click on Launch Now and go to your editor.

- Use the clues to fill out the relevant fields.

- Include your individual data and phone knowledge.

- Make guaranteed that you choose to enter appropriate data and quantities in suitable fields.

- Carefully test the information belonging to the form likewise as grammar and spelling.

- Refer to help you section should you have any questions or handle our Help group.

- Put an electronic signature on the Form DA-4856 using the guide of Sign Instrument.

- Once the shape is accomplished, press Performed.

- Distribute the ready sort by using email or fax, print it out or conserve on your own unit.

PDF editor allows you to definitely make variations with your Form DA-4856 from any World Wide Web connected product, personalize it based on your preferences, indication it electronically and distribute in several ways.

What people say about us

It's a great idea to send forms on-line

Video instructions and help with filling out and completing Form DA-4856